Do you want to know what are the mortgage rates today? When you are buying a house, refinancing your home, or making a second loan, rates would be one of the most important topics you will have to deal with.

Real estate expert Joe Mays once said, “the universe of mortgage lending has gotten to the point where there is a place in it for everybody.” In that line, you will have a variety of lending options and mortgage rates. There are, however, different types of mortgage rates that work for different people.

Remember that you can lose thousands of dollars if your lending rate goes up or down by just one point. That’s why experienced home-buyers always check the mortgage rates for the season they are looking for a new house.

We will discuss how mortgage rates affect your monthly payments, how much you would have paid at the end of the loan period, and, of course, what options you have to reduce your mortgage payment.

Ladies and gentlemen, let’s talk about what are mortgage rates today.

What are mortgage and their rates?

A mortgage is a loan to purchase a home. Therefore, a mortgage rate is the percentage of interests you will pay to the lender as retribution for the money he loaned to you.

Usually, the interest covers the risk associated with the loan, your credit situation, the costs involved in lending the money, and the macroeconomic conditions surrounding the jurisdiction of your house.

Finally, the interest rates also included the money the lender will make due to your business.

Among the factors that will impact your mortgage rate will be the type of loan, your credit score, size of the downpayment, the location of the property, and the time you will spend paying back the money.

After calculating all those factors, and others, you will be given an annual percentage rate, also known as APR.

The APR is the interest rate plus fees, mortgage insurances, and discount points. It will be the mortgage rate you will pay during the whole loan term. Of course, in the case that the agreement you reach is for a fixed rate.

Types of mortgage rates today

There are two main types of mortgage rates: Fixed and Adjustable rates. Fixed rates are the mortgage that will have a unique interest rate across the life of the loan. It will never change.

On the other side, an adjustable-rate mortgage will experience different rates during the loan. It could go up and down regularly. It can also have a time of fixed rates and then variable conditions.

Another differentiation regarding mortgages rates is the kind of loaner. Mortgages can be issued by private institutions and government-backed organizations such as the Federal Housing Administration and Veterans Administration.

Now, when it comes to talking about terms, the length of a mortgage usually varies from 10 to 30 years. The shorter period of time, the lower the interest rate will be.

What are the most popular terms for mortgage rates today:

- 30-year fixed rate

- 15-year fixed rate

- 10-year fixed rate

- 30-year fixed rate FHA

- 30-year fixed-rate VA

- 7/1 ARM

- 5/1 ARM

- 3/1 ARM

It is not just about today; how do mortgage rates trend across the years

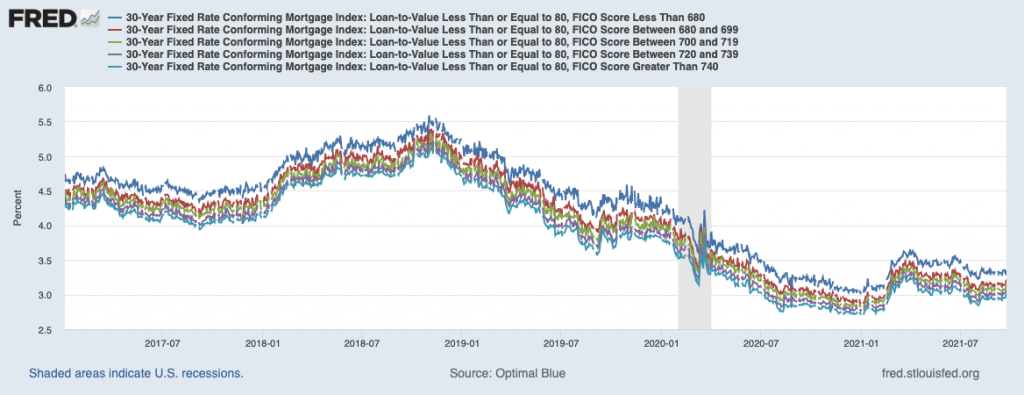

The best way to understand mortgage rates today is to know what they were like in the past. The benchmark 30-year fixed-rate mortgage average is currently at historic low levels, around 2.86 per cent. Just above all-time lows of 2.65 per cent reached on January 7, 2021.

Today’s mortgage levels are at minimums due to the Federal Reserve’s current expansionary monetary policies. The American central bank lowered the benchmark federal funds rate, purchased bank bonds instruments, and injected money directly into the economy in order to help the United States’ economy in hard times.

Federal Reserve’s actions pushed down the value of money, so people would be able to get better financing conditions and, therefore, purchase more things as a way to revamp the economy.

In other words, expansionary monetary policies increase the supply of money in the economy and relax the credit conditions to generate economic growth. In that way, people can get cheaper car loans and house mortgages among other things.

What are mortgage rates today while comparing with historical levels?

Mortgage rates have not been that low always. Following the COVID-19 pandemic impact on the economy, both the Federal Reserve and the United States government started economic stimulus to support the economy.

Economic stimulus pushed mortgage rates down to current levels around 2.86 per cent. It also fueled the real estate market to highs. However, just in 2018, the 30-year fixed-rate mortgage average in the United States was at 4.94 per cent, the highest level in the last ten years.

In a more historical view, the 30-year mortgage rate experienced an all-time high of 18.63 per cent in the years of the 1980 recession, where the Federal Reserve tightened its monetary policy in an effort to fight high inflation.

So, if you think that your mortgage rate today is too high, think twice!

Making the decision to buy a house now and enjoy historic low levels would allow you to purchase a more expensive home with a lower interest rate.

Following all-time highs in September 1981, 30-Year Fixed Rate Mortgage rates started a multi-year megatrend that brought their average rates to current lows, cutting them by over 15 basis points in 20 years.

However, it does not mean rates will stay that low indefinitely. The best option is to check out all your options and to remain open to new opportunities.

What factors determine your mortgage rates?

Factors that affect your mortgage rates include the location of the property, your income and liabilities, the size of the down payment, the terms and type of the loan as well as your credit score.

The rule of thumb is that you can afford a mortgage loan that is two and a half times your annual income. Consider the case of you earning $100,000 per year. This means you can afford a mortgage of around 250,000 to 300,000 dollars.

Please remember that this is just a guideline. All other factors are important, too. The same $100,000 of annual income could allow you to afford a larger or smaller mortgage, depending on your economic situation.

How much should a first-time homebuyer put down? Most people think that somewhere between 10 and 20 percent of the house’s value would be fine. Here are two related questions, however.

First, how much should a first time home buyer put down? If you’re a first-time buyer, you could obtain a low-down-payment mortgage provided or backed by the government. If you qualify, a 3 percent down payment would be sufficient to purchase a home.

Second question: Can I buy a house with no money down? Yes, you can get a mortgage with no down payment if you get a government-backed loan. Government programs in the United States allow low-income families to get their own homes by insuring them.

Would you be interested in government-sponsored loans? Find out more about VA and USDA loans. If you’re trying to buy your first home, it may be the right choice for you.

Federal Reserve’s interest rates

The Federal Reserve System is the central bank of the United States. It controls all the money supply in the economy, the value of money and, of course, the interest rates. Hence, as you may have guessed, the Federal Reserve plays a crucial role in mortgage rates.

In the United States, the Federal Open Market Committee, or FOMC, meets around eight times per year to discuss the country’s economic situation and decide the best strategy to support the economy.

A healthy economy is the Federal Reserve’s mandate, so the FOMC works toward high employment and stable prices.

Federal Reserve policies can boost or cool the economy through a variety of instruments, such as interest rates, bond-buying programs, and reserve requirements. One that directly affects mortgage rates is the federal funds rate.

What is the Federal Reserve funds rate?

According to the Federal Reserve, “The federal funds rate is the interest rate that financial institutions charge each other for loans in the overnight market for reserves.”

Therefore, all private banks and financial institutions are affected by the interest rate set by the central bank. As a result, if the Federal Reserve reduces interest rates, your mortgage rate will go down. Conversely, mortgage rates will go up as the Fed hikes its funding rate.

You should keep in mind that a fixed-rate mortgage involves using the mortgage rates on the day when you are planning to buy a house, and then rate fluctuations will not affect the loan.

However, if you sign for a variable interest rate loan, you will have to pay attention to what are the mortgage rates today and every day as they will fluctuate in line with the Federal Reserve’s decisions.

Long story in short, it is a good idea to check Federal Reserve’s monetary policy stance in order to anticipate when interest rates would be lower or higher, and then take a smart homebuying decision.

How does the long term impact your mortgage?

It is crucial to understand how mortgage rates are today and when they are likely to go lower so that you can save money over the course of the loan.

When you shop for a fixed-rate mortgage, you just have to pay attention to the rate on the day you are closing your deal. Throughout the life of the loan, the mortgage interest rate will remain the same.

However, when you choose a variable interest mortgage, you should consider the fluctuation of the rates.

How much difference does a 0.25 percent discount matter?

Now let’s look at how different interest rates affect your loan. In other words, how much difference does 0.25 percent make on a mortgage?

First, let’s clarify that the amount of money will depend on how much money you are taking.

If you took out a 350.000 dollar mortgage at 4 percent fixed interest and a 30-year term, you would pay approximately 1.671 dollars monthly for 30 years, for a total payment of 601,560 dollars.

Suppose we’re to borrow the same 350,000 dollars at a rate of 3.75 percent. A 30-year fixed-rate loan would have cost you $583,560.

It’s for this reason so many people choose to refinance when rates are low.

Imagine you got a mortgage refinance loan for 350,000 dollars, with two percent interest. The total amount of money you would have paid after 30 years would be 465,840 dollars. This represents a savings of 135,720 dollars!

What is the best credit score to get a mortgage?

Financial institutions and other lenders offer their best rates to people with excellent credit scores. It works similar to when you are taking a car loan, but the amount of money is more significant, and the impact of different interest rates would be huge, as we have already seen previously.

Credit scores above 740 are considered excellent. Borrowers with a 740 score will get the best deals. That’s true, but it doesn’t mean you can’t get a mortgage at a competitive rate. Government-insured mortgages such as the FHA or the VA accept credit scores as low as 580.

That being said, it is essential that you understand how to improve your credit score and plan your house hunting in advance, so that you can boost your score and get the best deals available.

Is it a good time to buy a house today?

The current mortgage rates encourage people to buy houses. Every year, about a million homes change hands, and people are more likely to request a mortgage today than they used to be.

What’s the reason? Current historically low rates are not expected to last much longer. Therefore, borrowers are eager to take advantage of cheap money before the Federal Reserve raises rates.

What is your current economic situation, however, is what you need to consider before you start house hunting. Are you ready to enter into an enterprise like the buying of a house? This is a very serious commitment as well as the dream of millions.

As a result, the first step is to analyze your economic situation and understand how much mortgage you can afford. The next step is to check what the mortgage rates are today and their forecast for the medium term. Next, you should research what kind of mortgage works best for you.

Lastly, if the conditions are right, a new house may be a good idea. In that case, best of luck with your search, and congratulations on taking a new step!